Do You Have Retirement Confidence?

The services you need. The personalized planning you deserve.

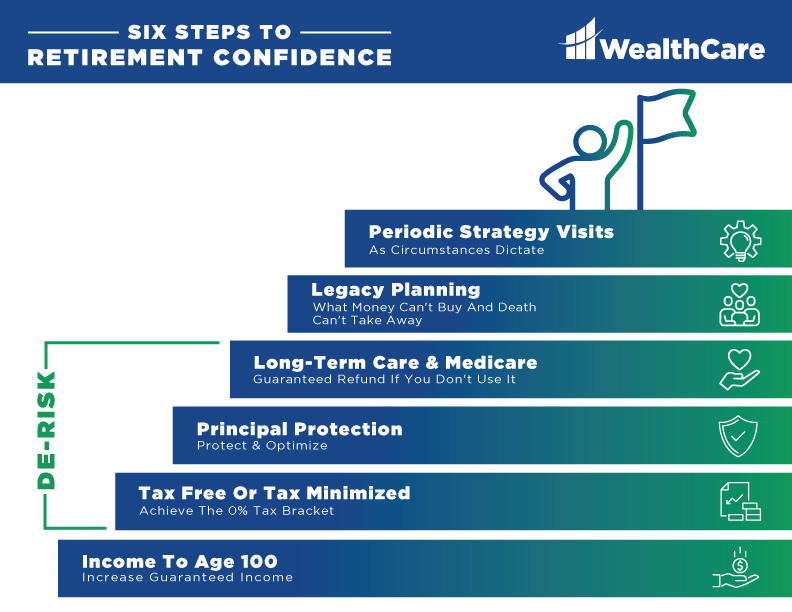

Six Steps to

Retirement Confidence

Working with thousands of clients over 31 years, we've discovered common concerns: Will you run out of money? How can you avoid taxes on Social Security? What can you do to earn while protecting your principal from stock market loss? How will you pay for long-term care? What is the best way to pass your assets to the next generation? Our comprehensive Six Steps to Retirement Confidence process is designed to address and arrest those concerns for you, as it has for many people before you, so you can enter retirement confident that your money will be there when you need it.

How much money do you need deposited into your account each month to pay your bills in retirement? Some of that will come from Social Security or maybe pensions and the rest from retirement savings. Let's figure out how long your retirement savings will last. Hopefully until age 100.

It's possible to achieve the 0% tax bracket in retirement. This means you pay no tax on Social Security and pay the lowest rate for Medicare, with no excess IRMAA charges. Even wealthy people can achieve this if they plan correctly.

Everyone should have a percentage of their assets protected from risk, so that no matter what happens that money doesn't lose value in a bad market, and it retains its potential to grow.

The average family faces over $300,000 in healthcare costs in retirement, and three out of four retirees are likely to need long-term care. This can decimate your retirement savings and leave a surviving spouse in the poor house. Let's develop a plan to protect against that risk.

You might have a will or trust. But there are things that money can't buy and death can't take away. Aren't those more important than money? How are you transferring those assets to the next generation?

To ensure ongoing confidence, we meet every year to review these six steps and make sure you: have the income you need; aren't paying more in taxes than you should; have your assets protected and growing; get the best deal on Medicare supplements; and have your assets protected from in-laws who become outlaws, lawsuits, and such. This allows you to remain financially confident throughout your retirement.